By Gabe Hochenberger – 10/26/23

Introduction

As a member of The Energy Co-op, you know that at the heart of our mission lies cooperation—an ethos that transcends the traditional profit-driven model. Cooperatives are member-owned enterprises, united by a common purpose and democratically governed by those who benefit from their services. Borne out of the desire for collective empowerment, they serve as beacons of community resilience, emphasizing shared values and mutual support. Much like its ownership structure, the cooperative model has a vastly different financial structure as well. From fostering innovation and building member equity to bolstering democratic engagement and placing people at the forefront, cooperative finance allows cooperative organizations to truly place their members first. As we wrap up this Co-op Month, let’s take a closer look at the financial world of The Energy Co-op to understand the cooperative advantage over the for-profit model.

Program Revenues and Costs: The Heart of Financial Planning

Creating a working budget is one of the most critical annual financial projects we complete at The Energy Co-op. Like a personal budget, our goal is to ensure that we account and plan for all funds coming in and going out of our organization in the upcoming year. A strong budget is at the heart of any organization’s financial health, and taking the time to create a detailed and thorough budget is vital to the overall financial wellbeing of our organization. A well-planned budget keeps The Energy Co-op on track with spending, holds the organization accountable, and creates an organizational plan for the year to come.

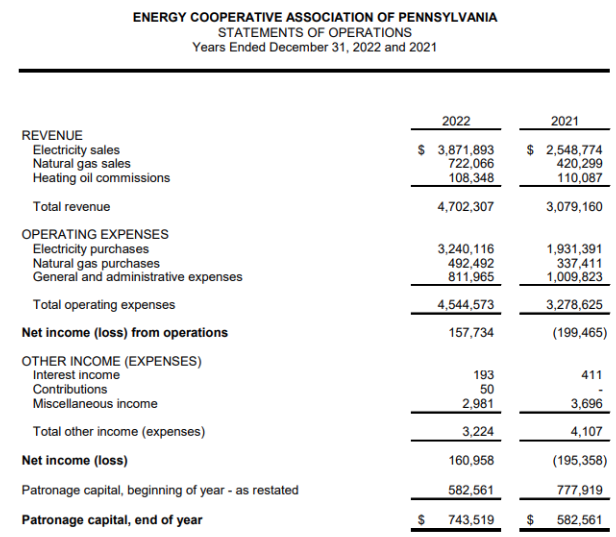

While every organization is different, the two most important pieces of The Energy Co-op’s annual budget are program revenues and costs. Nearly all generated revenue comes from membership, through monthly electric, gas, or heating oil usage billing. Unlike other industries that operate in less volatile environments, projecting energy revenue and costs is extremely difficult during the budget process because the figures are calculated based on usage, which is weather-dependent and difficult to predict over an entire year. Nevertheless, our Programs team works diligently to create the most realistic revenue and cost projections using all the data available to us. Subtracting the program cost projections from the revenue per month projections equals gross margin, which represents how profitable our programs are expected to be over a given period. This data is broken down in the annual budget by month, quarter, and yearly totals.

For instance, our Renewable Electricity Program generates monthly revenue-based membership payments to utilities, which is then received by The Energy Co-op. The program also incurs costs such as Renewable Energy Credit purchases, supply and transmission costs (the cost of delivering power to your residence), and compliance fees, just to name a few. The difference between the revenue and costs is the Renewable Electricity Program’s gross margin.

Operational Costs: Sustaining the Cooperative

When we talk about running The Energy Co-op’s Electric, Gas, and Heating Oil programs, there’s more to the story than just the direct costs. These other costs are called operational costs, which comprise the expenses needed to keep the organization running on a day-to-day level. Operational expenses are necessary for any organization to function, but they are not directly related to the programs an organization offers.

General and administrative, or G&A expenses are easier for us to project as they are not market-dependent, unlike program revenue and expenses. When we build out the G&A costs in the budget, we are predicting exactly how much we expect to pay monthly and annually towards categories like employee salaries, outsourced consulting, IT software, marketing efforts, and more. We need to predict costs per month as accurately as possible, as the budget is constantly referred to throughout the year, to ensure we are on track with our annual spending plan. Subtracting the operational costs per month or per year from the gross margin for that same period equals net surplus or deficit, which represents how much money an organization gained or lost over a specific period.

It might seem strange that a nonprofit cooperative could end the fiscal year with a net surplus, but that is common in the nonprofit world. Technically, some nonprofits can generate revenue, but it is how they manage revenue that can grant them nonprofit tax exemption status by the IRS. As shown in our published financial statements, net surplus or deficit on our statement of operations is shown as either an increase or decrease in membership equity on our cash flow statement. Understanding these behind-the-scenes costs helps to ensure The Energy Co-op is being transparent with our members about where we stand financially.

Cooperative Structure: What is a 501c12?

The Energy Co-op operates as a 501(c)12 tax-exempt organization, a designation granted by the IRS in recognition of the societal benefits an organization provides. Nonprofit organizations fall into various categories, such as 501(c)3 or 501(c)4, each delineated by distinct organizational purposes and financial criteria. While charities and religious groups are commonly associated with 501(c)3 status, our cooperative, functioning under a membership structure, qualifies for tax-exempt status as a 501(c)12.

Unlike charities that often rely on donations, our revenue is derived primarily from our members. The IRS distinguishes us from traditional charities based on this funding source. Specifically, as a 501(c)12 organization, we must generate a minimum of 85% of our annual revenue from our members through our three programs: renewable electricity, renewable gas, and heating oil. The remaining 15% can be sourced from grants or donations, and The Energy Co-op has undertaken various fundraising campaigns to speak with a louder voice and bolster renewable energy in PA. IRS regulations dictate that all revenue generated by a 501(c)12 must be directed towards current or future liabilities (including costs of goods sold and operating expenses) or distributed to members through dividends. Notably, a 501(c)12 is inherently member-owned, affording members control over the business’s actions, direction, and leadership. This unique structure underscores our commitment to member empowerment and ensures alignment with our cooperative principles.

Membership Equity: Connecting the Cooperative Advantage to Your World

Membership equity is calculated by taking The Energy Co-op’s total assets and subtracting all current and future liabilities. Membership equity is a good indicator of the financial health of a member-owned cooperative. With the unique structure of our organization, the membership equity total is technically all funds available for our members to claim if we were to liquidate all assets and pay off any outstanding liabilities.

While some cooperatives elect to pay out portions of their equity to their members via dividends, we at The Energy Co-op opt to use our member equity towards offering the lowest possible rates for our members! By channeling member equity into keeping costs low, we ensure that the benefits of our cooperative extend to as many members as possible, fostering an inclusive energy community. By keeping prices low and growing our organization, The Energy Co-op can convert more Pennsylvanians to renewable energy and further our shared mission of a greener Commonwealth.

We also use member equity to invest in our current or future programs and increase our general efforts to advance the mission we share with our members. In essence, member equity serves as the cornerstone of our cooperative philosophy, underpinning our dedication to affordability, sustainability, and progress. Through equitable growth, The Energy Co-op uses the collective power of our ownership to strive for a clean energy future.

Membership Equity and Cash Reserves

The best way to illustrate the importance of membership equity reserves would be to use a real-life example of a time when having membership equity helped ease a financial burden at The Energy Co-op and ensure our long-term viability. In January 2014, polar vortex conditions across the United States caused temperatures to plunge and energy costs to soar, specifically in the northeast region due to rapid demand increase. Like most energy suppliers during this time, The Energy Co-op suffered financial hardships as program costs increased unexpectedly. Because electricity rates are set at the beginning of each month, we could not adjust rates mid-month to balance the cost increase and reduce our financial exposure. Thankfully, The Energy Co-op was able to incur the unexpected costs in the month due to our membership equity. This “emergency fund” allowed us to operate at a net loss without discontinuing our operations. Importantly, member equity enabled The Energy Co-op to continue regular operations without dramatically raising our members’ rates in later months to recoup our polar vortex losses.

A cash reserve is vital to running a financially stable organization, especially in the highly volatile energy industry. Membership equity gives us a safety net for unprecedented situations by allowing us to dip into a cash reserve instead of passing unexpected costs on to our members via increased energy rates. The Energy Co-op has recently revised our forward purchasing strategy for energy to reduce the risk of market volatility having a sizeable negative effect on our financial position. With this updated risk policy in place, we have ensured that the organization is financially stable with on-hand equity and is well equipped to handle market volatility while keeping rates as low as possible and competitive for our membership.

Conclusion

The Energy Co-op’s financial strategy is rooted in cooperative principles and stands as a beacon for a sustainable energy future. Through meticulous budgeting, we navigate the often-volatile energy landscape, ensuring transparency and accountability. Our 501(c)12 tax-exempt status, unique in its member-centric approach, solidifies our commitment to empowerment and cooperative values. Membership equity serves not just as an indicator of financial health, but as a driving force for affordability and sustainability. As we continue our journey, our focus remains on empowering our members, providing competitive rates, and advancing the cause of sustainable energy with our members at the forefront of everything we do.