By Divya Desai, Eleanor Fulvio, Lauren Keller, and Colin Teague – 2/6/2025

Changes in Energy Capacity and What They Mean for Pennsylvania Consumers

What is Capacity?

Capacity refers to the maximum amount of electricity that a power plant, energy resource, or grid infrastructure can reliably produce or handle at any given moment. Capacity is usually measured in megawatts (MW). Generation capacity refers to the total amount of electricity that power plants (whether renewable, natural gas, nuclear, etc.) can generate at peak output, while transmission capacity refers to how much electricity the grid’s transmission lines can carry from power plants to consumers without becoming overloaded.

How Does Capacity Work?

The Commonwealth of Pennsylvania is part of PJM Interconnection, the grid operator that manages the regional electrical grid. Every PJM member that sells electricity to consumers is responsible for buying capacity on the PJM capacity market, called the Reliability Pricing Model (RPM), which is intended to ensure there is enough generation to reliably meet demand at any given time plus a buffer to cover uncertainty in times of peak demand.

In this system, power supply resources are paid additional revenue from the capacity market in exchange for their ability to deliver electricity to the grid when needed or, conversely, are penalized should they fail to perform. In the context of continually rising demand, the capacity auction is intended to act as both an insurance policy against supply interruptions and a price signal to attract further power supply investment to ensure demand can be met in the long term. The cost of buying capacity is factored into the per-kilowatt hour supply rates suppliers like The Energy Co-op charge consumers for their electricity. Capacity cost is also included in utilities’ prices to compare (PTCs).

What is Happening to Capacity in PJM?

Energy generation projects go through a number of key stages before being approved by PJM and brought online. This process includes project planning to determine factors like technical feasibility and site assessment, regulatory approvals and permitting, project financing, installation and grid connection, and system testing for operational readiness. Throughout the past 12 months, PJM Interconnection has seen a significant surge in energy projects entering the interconnection queue. Due to this backlog, PJM has stopped accepting new applications and continues to move too slowly to approve new requests.

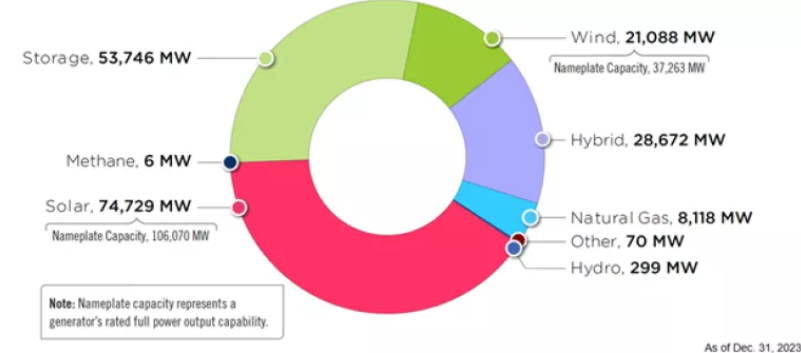

Resource types waiting in PJM interconnection queue

This means that the expected growth in energy capacity, specifically in regard to renewable energy, may not materialize as quickly as anticipated. Renewable projects’ lower operating costs compared to fossil fuel plants typically offset their high upfront costs, leading to lower net costs in the long term.

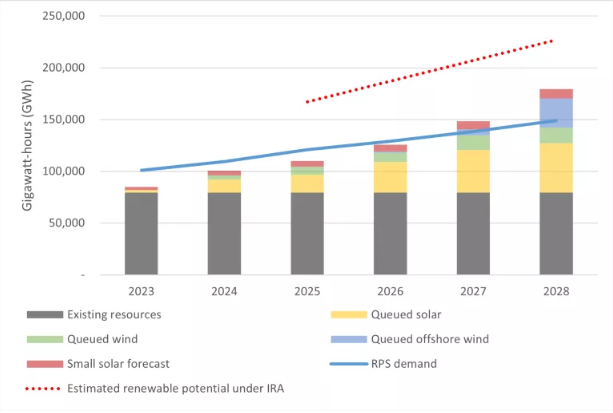

Projected RPS-eligible renewable resource supply in PJM shows little wiggle room to meet RPS demand

For Pennsylvania energy consumers, this situation presents challenges and opportunities. While the influx of new projects holds promise for a cleaner, more diverse energy mix in the future, the slow pace of construction and permitting could delay the benefits of this transition. Despite the 38 GW of renewable generation capacity with interconnection agreements, which is considered a sign of progress, questions remain about the actual timeline for these projects to come online. As PJM’s data shows, only a portion of this capacity—around 22 GW—represents effective capacity, with some still in the permitting stage or under construction. This slower-than-expected build-out is compounded by developers’ strategic choice to wait for interconnection agreements before proceeding with permitting.

As a result, Pennsylvania consumers may face ongoing uncertainty regarding prices in the short term, with the promise of renewable energy integration potentially taking longer than originally expected. Until renewable projects can be connected to the grid, energy consumers in Pennsylvania could face higher short-term electricity prices due to reliance on more expensive fossil fuel-based power. Over the long term, the state’s shift to cleaner, more affordable energy sources could be slowed down, meaning that the benefits of cheaper and cleaner energy would take longer to materialize. And while Pennsylvania is working towards expanding its clean energy capacity, delays in the interconnection process could slow down efforts to stabilize energy costs through increased renewable energy generation, affecting both household budgets and the state’s efforts to meet its renewable energy goals.

How Will PJM Capacity Costs Increase for Delivery Year 2025/2026?

In the most recent PJM capacity market auction held in July 2024 for delivery year 2025/2026, which covers June 2025 through May 2026, the capacity cost rose to $14.7 billion, up from $2.2 billion in the previous delivery year. Capacity cost increases will affect everyone in the PJM footprint with the highest spikes hitting Dominion Energy and BGE utility zones in parts of Maryland, Virginia, and North and South Carolina. Suppliers in these areas will experience six- to seven-fold increases in their capacity costs. Elsewhere in PJM, including in Pennsylvania’s utility territories, the effect will be somewhat smaller, though still a steep increase compared to the prior year. Most electricity suppliers, including the default service providers (utilities), will likely pass all or a significant portion of these capacity cost increases on to consumers.

According to PJM, the capacity cost hike is a result of power plant retirements, increased demand, and new PJM market rules. Some also point to shortcomings in the PJM capacity market construct, which excludes reliability must-run (RMR) resources, or power generators that have been contracted to delay their retirement for the sake of maintaining system reliability and because of a lack of newer resources to take their place. Ratepayer advocates claim that this exclusion of RMR resources artificially inflates prices and is responsible for about a third of the $14.7 billion capacity cost for 2025/2026. They also blame PJM’s interconnection queue, which has been a huge bottleneck in adding new generation to the grid, despite signs that demand would eventually outpace supply.

The capacity cost issue is complex and has no single solution. Yet, the July auction served as a wake-up call to all stakeholders. Some steps are being taken to bolster the grid and potentially keep capacity costs from increasing even more. For instance, a revised interconnection process is in the works that would fast-track certain shovel-ready generation projects in PJM, an initiative that could be approved by FERC sometime this month. This Reliability Resource Initiative (RRI) generally has the support of state utility regulators and utilities; however, others, such as the Sierra Club and other advocacy organizations as well as renewable energy developers oppose the RRI, saying it could lead to delaying other projects waiting in the interconnection queue and unfairly favor certain projects, like thermal sources. Additionally, originally scheduled for December 2024, the next PJM capacity auction for delivery year 2026/2027 has been delayed until mid-2025, which could allow time for potential cost-saving solutions to be implemented. That said, any actions taken now would likely only be stopgap measures. Even with the implementation of some of these measures, early indications signal that inflated capacity costs are here to stay for the time being until electricity generating capacity catches up to anticipated energy demand.

On December 30, 2024, Pennsylvania and the Shapiro Administration filed a lawsuit against PJM with FERC asking that they order PJM to protect consumers from exorbitant capacity prices by lowering its price cap. At the end of January, PJM and the Shapiro Administration reached a tentative agreement that would set a capacity price cap of $325/MW-day and a floor of $175/MW-day for delivery years 2026/2027 and 2027/2028 if it is approved by FERC. For context, the previous cap was over $500/MW-day, and the price for the current delivery year 2024/2025 for most of PJM is around $29/MW-day. While this new proposed cap is certainly better than the alternative and limits future increases, it doesn’t alleviate the strain that will be felt in delivery year 2025/2026. The inclusion of a floor also ensures that prices will remain several times higher than those in the current delivery year.

Elevated capacity costs in PJM are expected to persist for the foreseeable future as fossil fuel power plant retirements proceed and demand continues to swell with increased electrification, the construction of energy-intensive datacenters, and the adoption of EVs. Ultimately, new generation assets will need to be added to the grid more quickly than has been the case in recent years in order to curb capacity costs and catch up to soaring demand.

How Will PJM Capacity Cost Increases Affect The Energy Co-op?

In PECO and PPL utility territories, where The Energy Co-op operates, the capacity clearing price jumped to about $270/MW-day for 2025/2026, up from about $50-$57/MW-day in 2024/2025. For The Energy Co-op’s total membership, this translates to a fivefold monthly capacity cost increase starting June 2025. While this will undoubtedly necessitate rate increases across all our electricity products, we will strive to keep our rates as affordable as possible and look for ways to bring down costs as well as innovate in other areas over which we have control. With greater capacity costs for everyone (not just Energy Co-op members) here to stay for the foreseeable future, we pledge to keep our members informed and share more details as they become available. The Energy Co-op values transparent practices and will continue to communicate about changes that impact our membership and Pennsylvania energy consumers.